Redistributing wealth is key to invest in the future

The World Inequality Report 2022 proposes several policy options to redistribute wealth to invest in the challenges of the 21st century. We present revenue gains from different wealth tax scenarios on global multimillionaires.

Given the large concentration of wealth, modest progressive taxes can generate significant revenues for governments. In our modest progressive tax rate scenario, we find that 1.6% of global incomes could be generated and reinvested in education, health and in the ecological transition. The report comes with an online simulator so that everybody can design their preferred wealth tax at the level of the world or in their region.

Why tax wealth?

The past few years have been marked by a renewal of debates about progressive wealth taxation. While progressive wealth taxes have been on the decline in rich countries, they still exist in varying forms in several countries, such as the Netherlands, Norway, Spain or Switzerland. More recently, some countries have discussed or voted in favor of the introduction of new wealth taxes (such as Argentina). In several other countries, there have been discussions about wealth taxes based on detailed proposals (such as in the USA, Germany, the UK or Chile). This renewed interest in progressive wealth taxation has been stirred by two factors: the surge in aggregate private wealth relative to national income (Chapter 3) and the increase in wealth concentration (Chapter 4). This phenomenon was accelerated during the COVID crisis: while national income fell, the value of private wealth increased, and this increase was particularly extreme among billionaires.

While the debate on progressive wealth taxation is gaining momentum, progressive wealth taxes remain an exception to the rule rather than the norm across the world nowadays. However, most countries in the world already tax individual wealth with property and inheritance taxes. You may recall that overall tax revenue accounts for 30-50% of national income in rich countries, 15-30% in emerging countries and less than 10% in low-income countries. Wealth taxes on individuals–including property and inheritance taxes- typically generate 2-3% of national income in rich countries, 1% in middle income countries and 0.5% in low-income and emerging countries: they represent non negligeable fractions of total tax revenue.

Property taxes–and their equivalent in various countries, such as taxe foncière in France–are by far the largest component of total wealth tax revenue: they typically account for 80-100% of total tax revenue on individual wealth. Property taxes generally take the form of taxes on real estate and land, which have been levied in many countries for centuries. In pre-modern societies, where land and housing assets represented the bulk of wealth, property taxes were a means to collect revenue by taxing those who could afford to pay. Today, in most countries, property taxes are flat, i.e. proportional to value: whether an individual owns a €10 million mansion or a € 50,000 flat, they will pay the same tax rate. Furthermore, property taxes are due regardless of whether the owner has any mortgage debt on the property.

In contrast to previous property taxes, wealth and income taxation in the 20th century were characterized by the introduction of progressivity. With a progressive tax, the tax rate rises as taxpayers’ income or wealth increases. This progressivity was particularly steep in some countries in the 20th century. In the USA, the UK, Germany or Japan, top income tax rates reached 80% (or more) a few decades back, while rates remained much lower for bottom income earners. In the USA, very high income tax rates were no one-time anomaly: Between 1936 and 1980 the top income tax rate was consistently 70% or more. While most countries have reduced top income tax rates since 1980, progressive taxation remains the defining principle of modern income taxation: the higher the income or the wealth, the higher the tax rate.

Therefore, the flat rate on property tax stands in sharp contrast to modern progressive income and wealth taxes. Let us be clear: there is no real economic justification to flat property tax rates in the world today. This is the continuation of archaic tax regimes in modern times, which could have been acceptable in pre-modern societies but which are at odds with basic democratic conceptions of tax justice today. In many ways, today’s situation regarding wealth taxation is comparable to the situation prevailing in the early 20th century before the introduction of modern progressive income taxes. The existing wealth tax system is archaic and disconnected from the current socio-economic reality, but many economic interests and political forces are still supporting the status quo.

Modernizing personal wealth taxation

The best way to modernize property tax would be to extend its base to all forms of wealth, rather than just real estate, and to shift from flat rates to progressive tax schedules. In actual fact, this amounts to transforming flat property taxes into modern, progressive taxes on wealth. There is a widespread misunderstanding in the contemporary debate about progressive wealth taxation: some commentators, opposed to personal wealth taxation, have argued that wealth should not be taxed at all, but they generally forget the fact that personal wealth in the form of housing–the main asset of the middle class–is already taxed, albeit in a regressive manner. Today, the wealthiest mostly own financial assets, rather than real estate and land (see Chapter 4), which in real terms means that the property tax represents a much smaller fraction of the total wealth for multimillionaires and billionaires than for the middle class. Transforming property taxes into modern progressive taxes, encompassing all forms of assets, would be a major step towards a more coherent and integrated tax system.

Relatively low tax rates on wealth can yield substantial tax revenue, contribute to spreading wealth better, hence increasing the wealth-generation potential of billions of citizens entirely deprived of capital. Progressive wealth taxes also contribute to containing the rise of extreme wealth inequality, and therefore help to mitigate the potentially negative impact of extreme wealth concentration, such as the rise of monopolies or the risks of political capture by financial interests.

But wouldn’t wealth taxes harm the economy? The first answer is that personal wealth is already taxed almost everywhere (with property taxes) in a regressive way. The second answer is that we now have a relatively good understanding of what works and what doesn’t in terms of personal wealth taxation, thanks to a wide range of historical and contemporary examples of personal wealth taxes. In a nutshell, given the enormous increase in the aggregate value and concentration of private wealth in recent decades, it would be completely unreasonable not to ask more to top wealth- holders in the future, especially in light of the social, developmental and environmental challenges ahead.

Estimates for a global progressive wealth tax

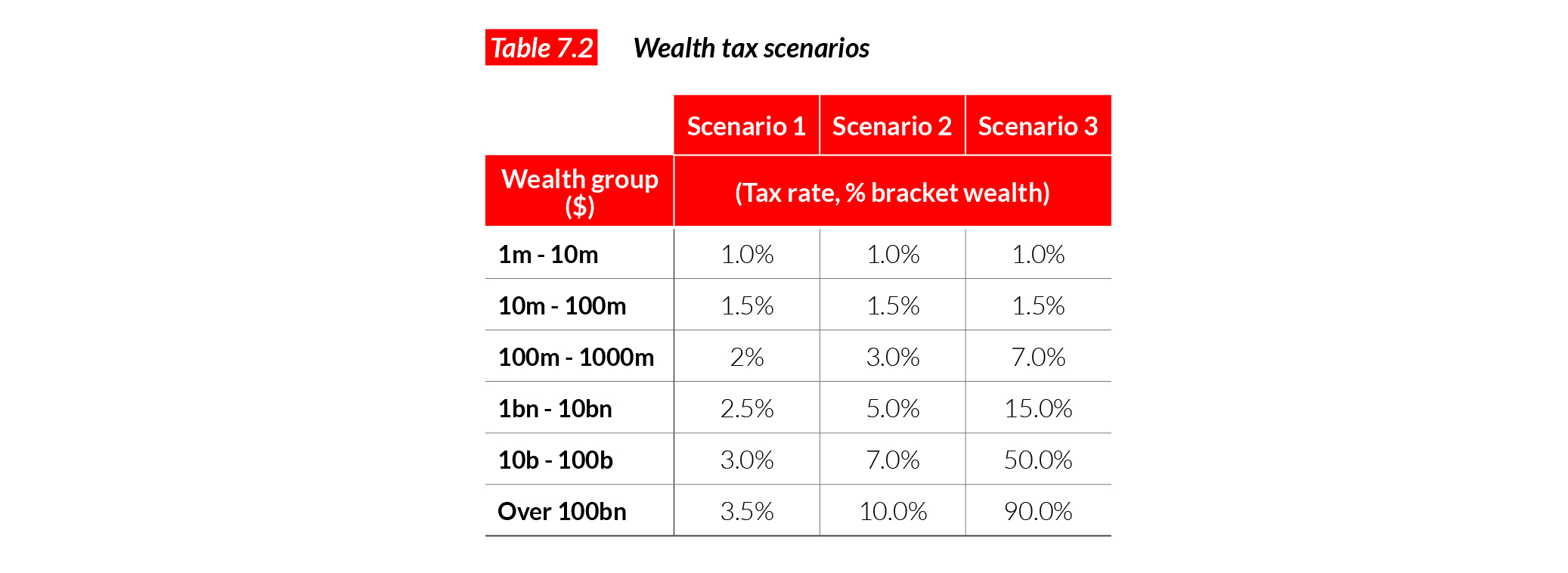

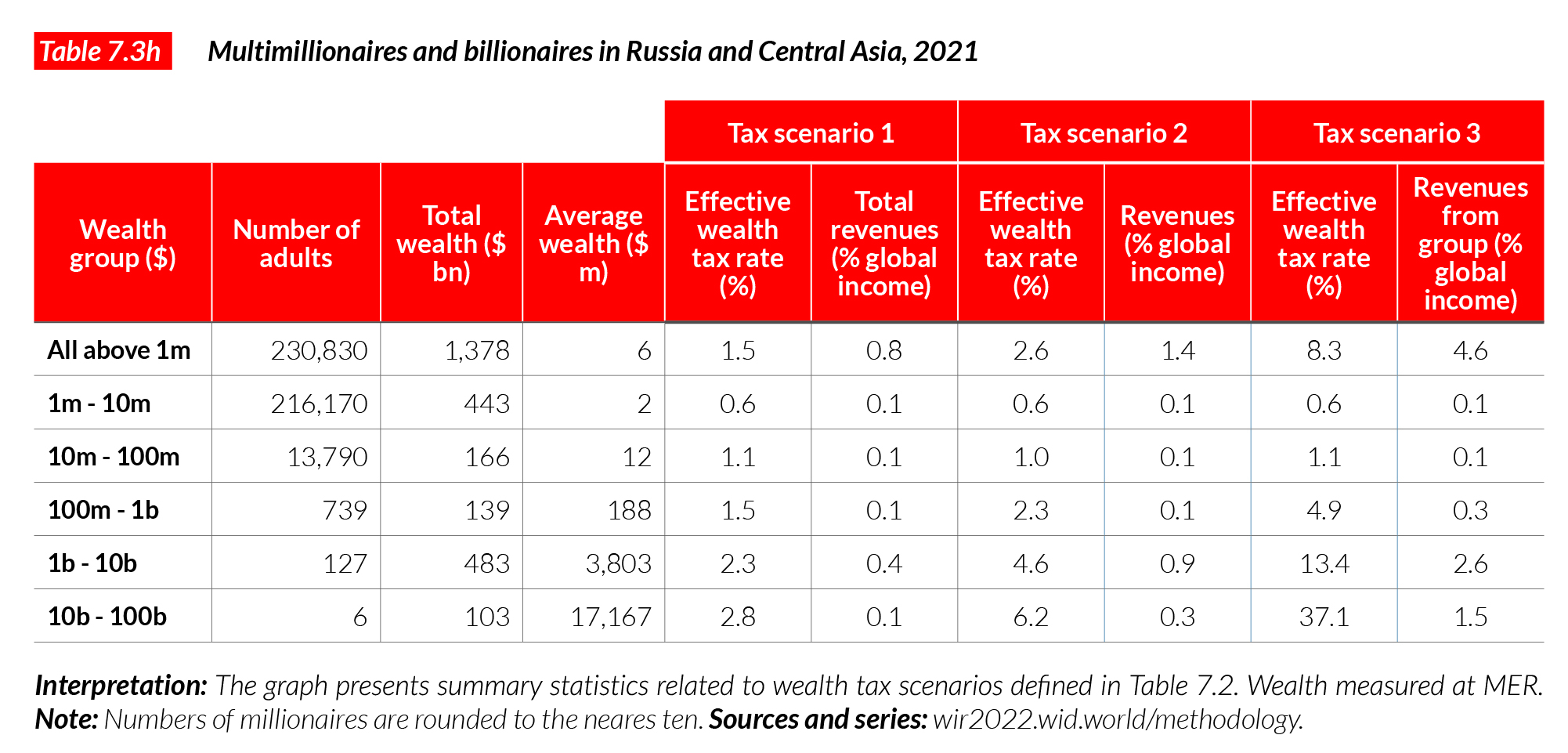

Below is a focus on the revenue potential from global progressive wealth taxes on millionaires and billionaires. These taxes could be implemented as a way to modernize and replace existing flat property taxes or be added on top of these. Our basic rationale, which we will further develop in Chapters 8 and 9, is that there is no sound economic justification for flat taxes on personal wealth when countries introduce progressive taxes on income – and even less so when they already implement personal wealth taxes. Here, we suggest three scenarios of progressive wealth taxation (low, significant and very high, see Table 7.2).

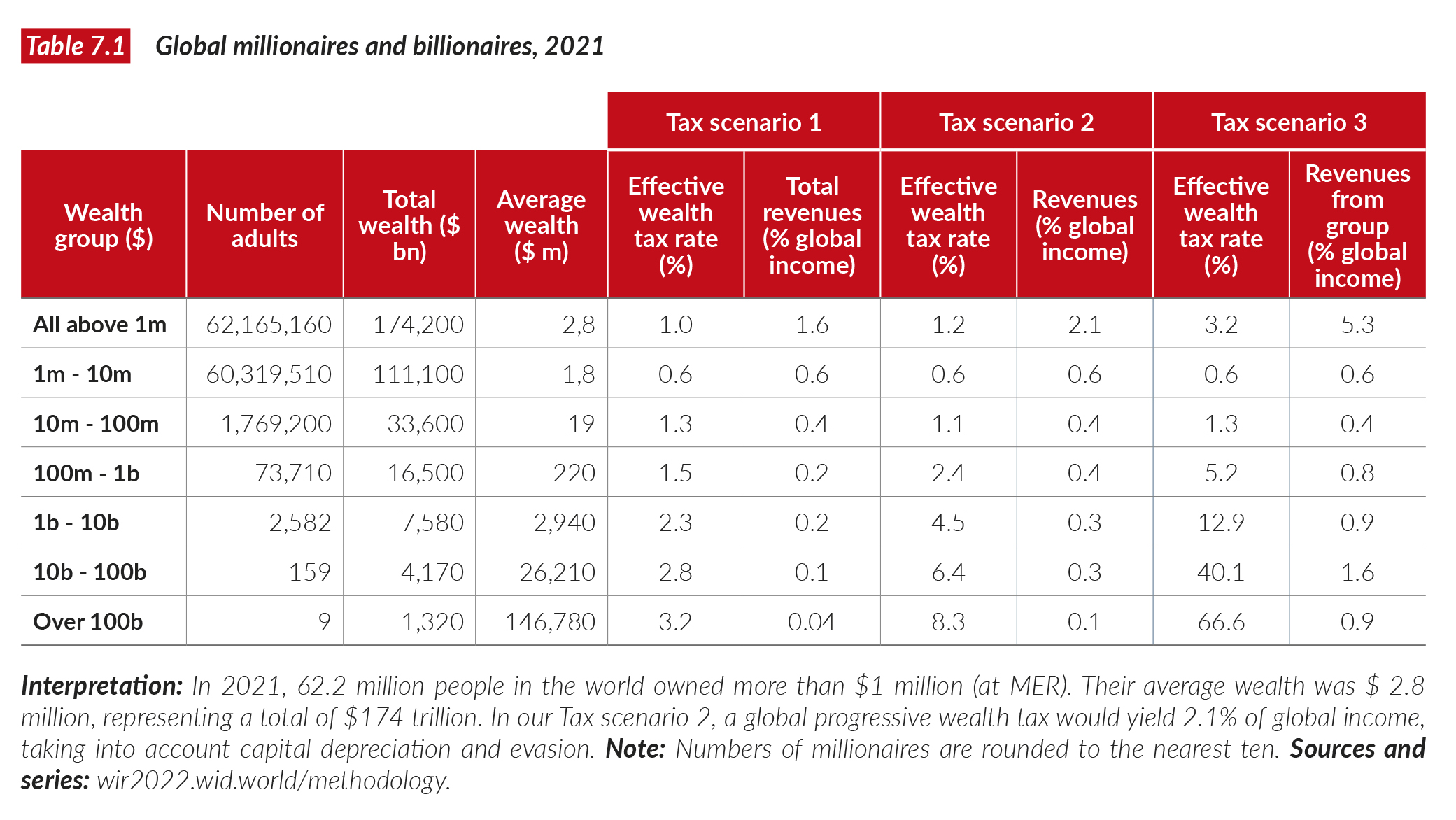

Table 7.1 presents the number of individuals in different wealth brackets in 2021, along with their total net wealth and the taxes they should pay according to three global wealth taxation scenarios. At the global level, there are 62 million individuals owning more than a million dollars at market exchange rates. This represents the top 1.2% of the global adult population. There are a little less than 1.8 million individuals owning more than $10 million (top 0.04%), 76,500 owning more than $100 million (top 0.001%) and 2,750 owning more than a billion dollars (top 0.00005%)1. Pooled together, global billionaires own more than $13 trillion, which amounts to 3.5% of global wealth.

Table 7.2 details the three tax scenarios we are considering. The rates presented are marginal rates, i.e. they apply to the fraction of wealth possessed between two thresholds and not to total wealth. The first scenario is a modest wealth tax proposal: between $1 million and $10 million, the rate is 1% and it rises progressively up to 3.5% for individuals owning more than $100 billion. This scenario generates 1.6% of global income in tax revenue after taking into account possible tax evasion and capital depreciation (see more below). Our estimates are relatively conservative, meaning that tax evasion could in practice be lower and consequently revenues higher (reaching up to 2.1% in this scenario).

In the second scenario (high wealth tax), the rate applied to individuals owning between $1 million and $10 million is also 1%, but it increases more steeply than in scenario 1. The tax rate is 5% between $1 billion and $10 billion and rises to 7% in the $10-100 billion bracket. On wealth over $100 billion, the rate is 10%. These rates should be compared with the average annual rate of billionaires’ increasing wealth over the entire 1995-2021 period: 7-8% (see Chapter 4). This means in real terms that wealth would have increased by 1-2% per year for billionaires in the $1- 10 billion bracket even after paying for the wealth tax. This scenario generates a wealth tax equivalent of 2.1% of global income, even when factoring in a fair amount of tax evasion.

In the third scenario, the rate applied on millionaires in the $1-10 million category remains unchanged but tax progressivity is even steeper than in scenario 2. Rates reach 50% over $10 billion and 90% over $100 billion. This would in effect ban wealth accumulation over $10 billion. The revenue generated in this scenario is equivalent to 5.3% of global income after tax evasion. Naturally, such a wealth tax scenario cannot raise such revenue for ever as it effectively prevents decabillionaires and especially centibillionaires from keeping their wealth.

Regional wealth tax estimates

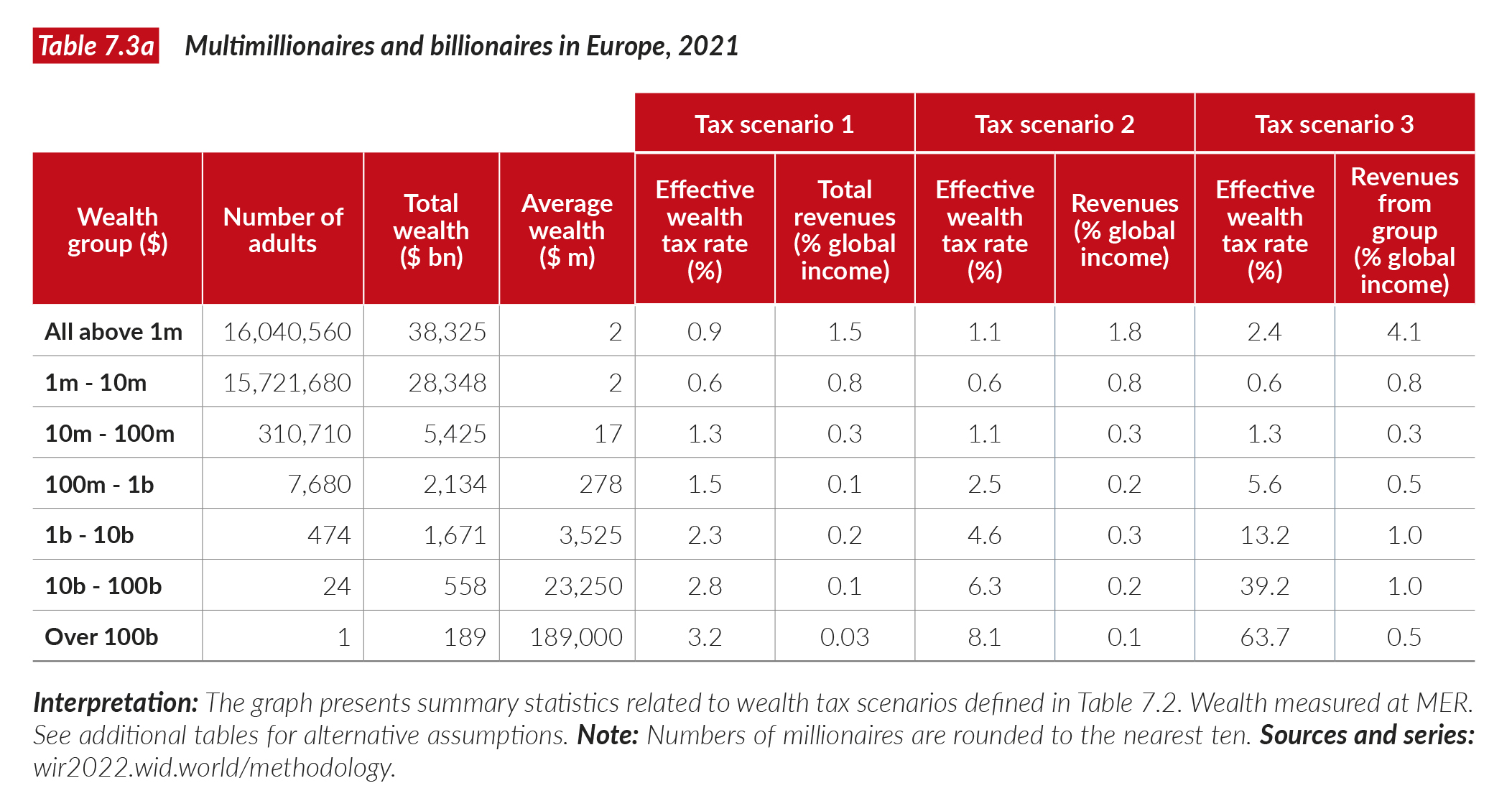

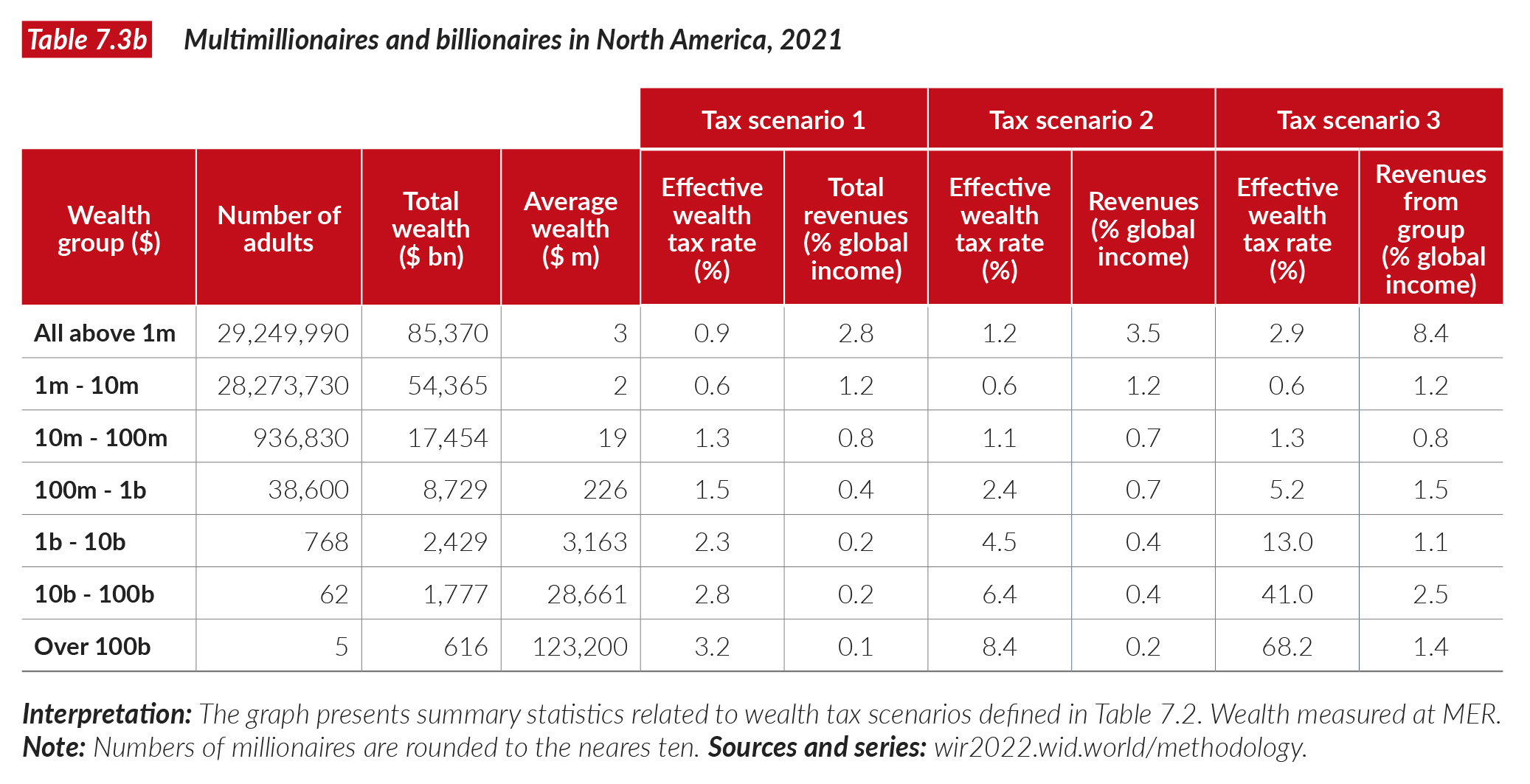

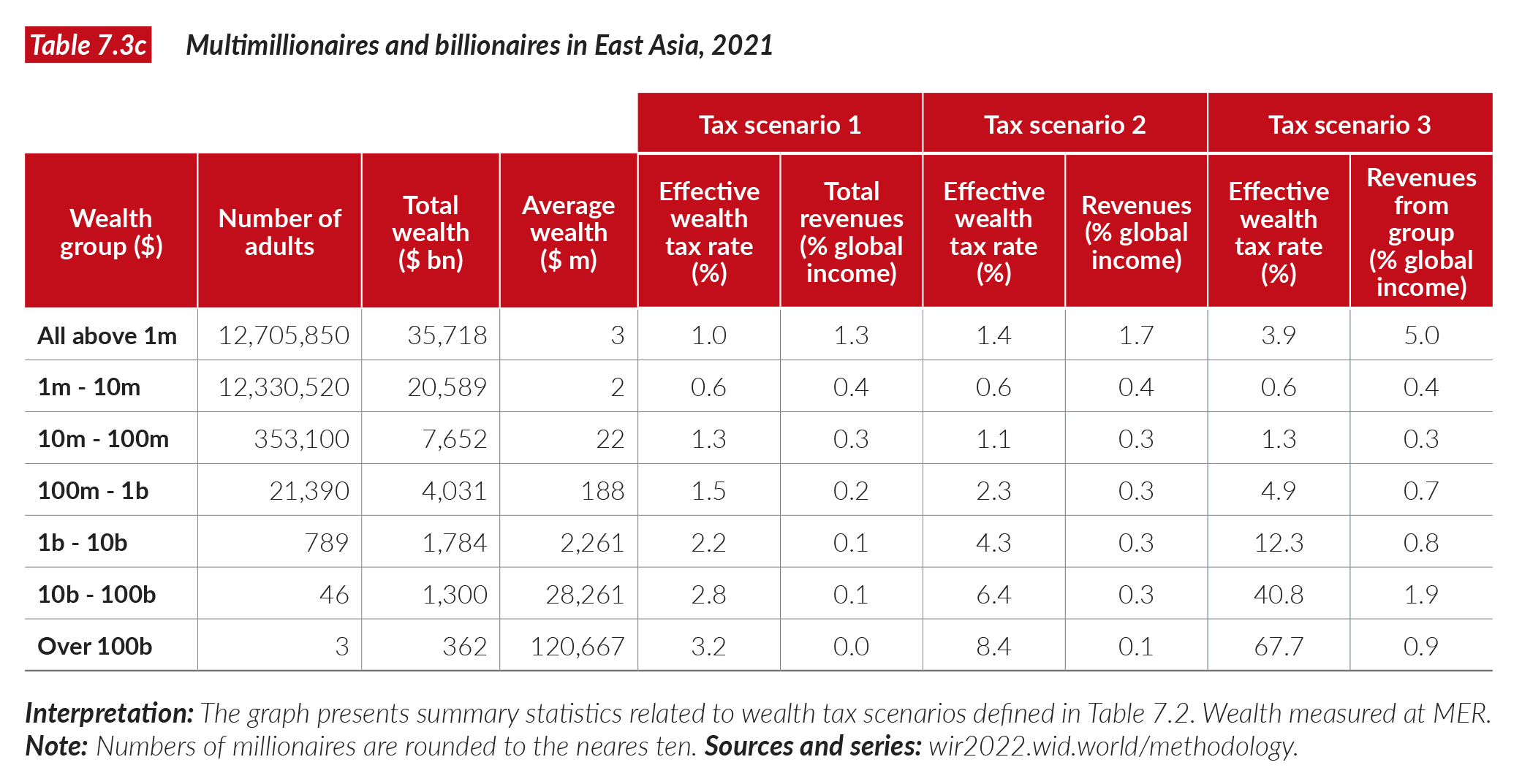

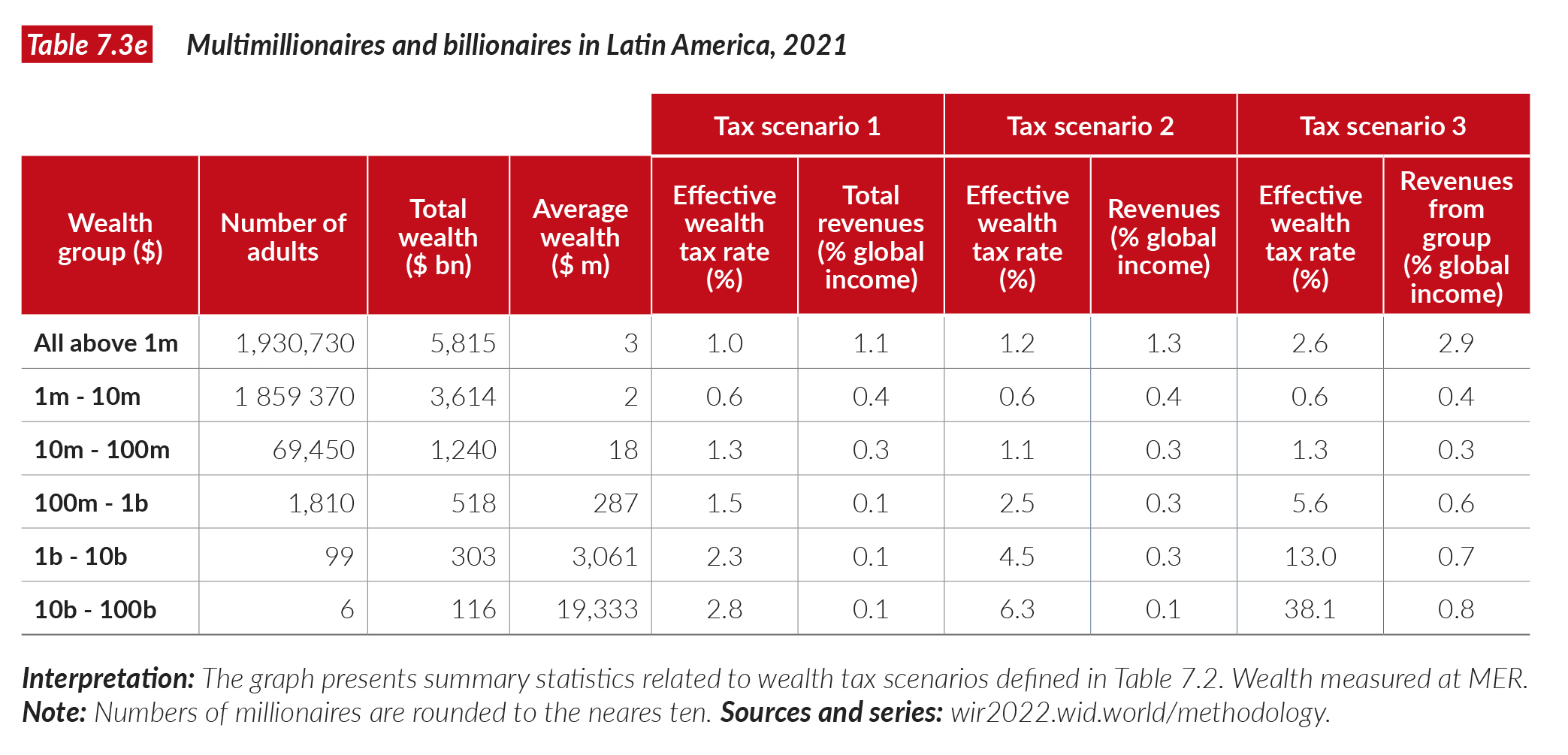

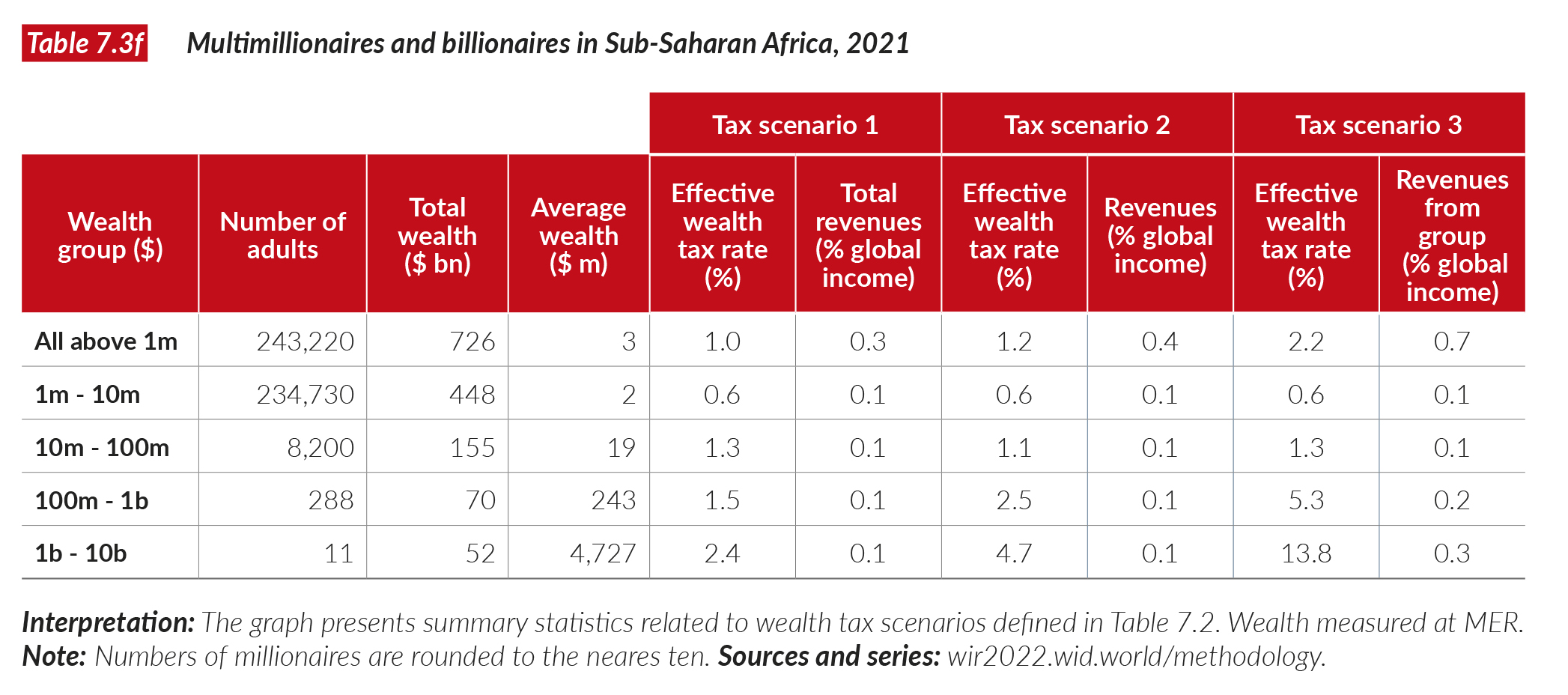

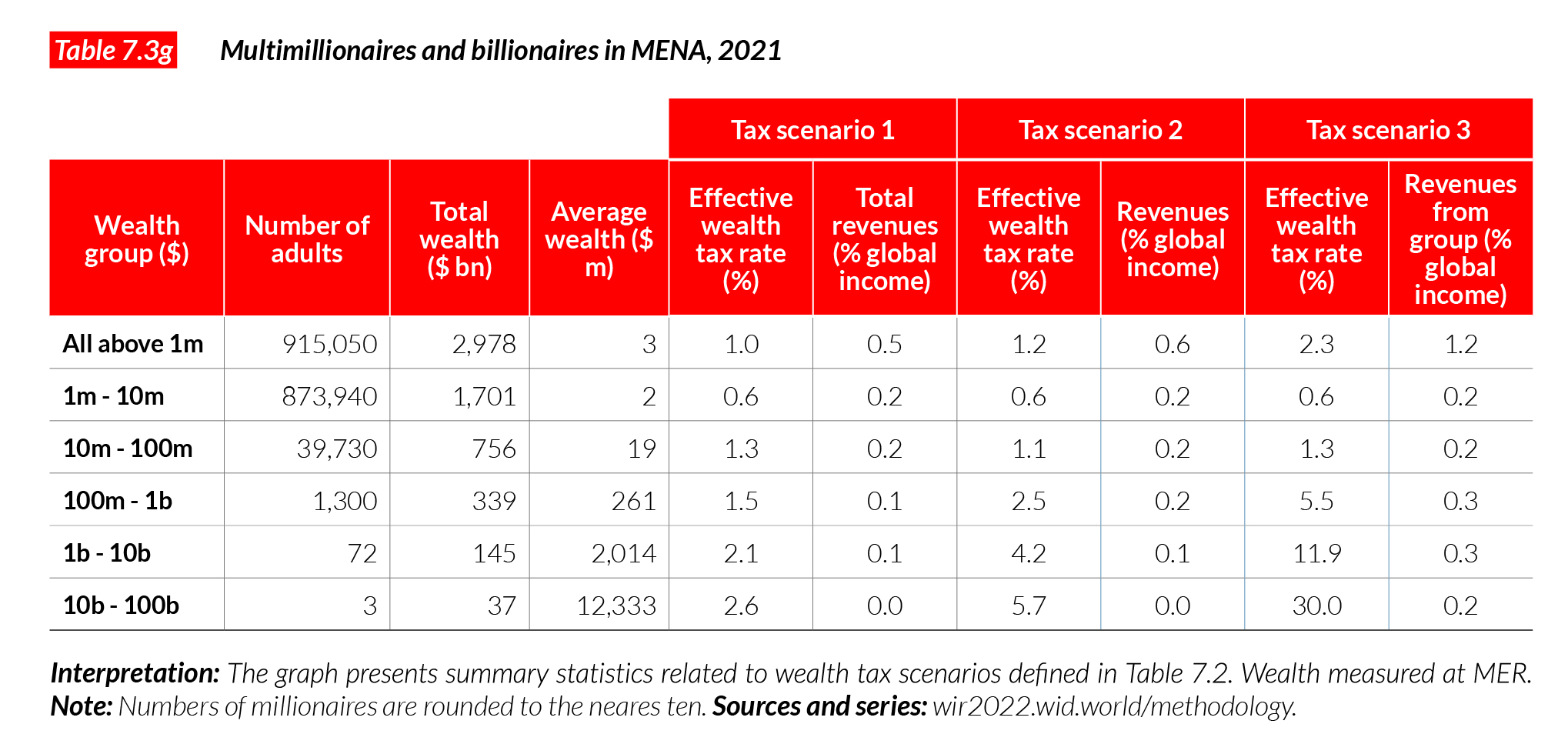

Tables 7.3a-h present regional wealth tax revenue estimates. In East Asia, 13 million individuals own more than $1 million. Under Scenario 1, wealth tax revenue accounts for 1.3% of regional income and is close to 1.7% in Scenario 2. In Europe, there are 16 million individuals owning more than $1 million and 499 billionaires. Total revenue under Scenario 1 would be 1.5% of European total income and 1.8% in scenario 2. In North America, there are 29 million people owning more than $1 million and 835 billionaires. Total tax revenue under scenario 1 accounts for about 2.8% of total income and revenue in scenario 2 accounts for 3.5% of total income. In Sub-Saharan Africa, there are 240,000 people owning more than $1 million and 11 billionaires. Total tax revenue under scenario 1 accounts for about 0.3% of total income and revenue in scenario 2 accounts for 0.4% of total income. In South and South-East Asia, there are 850,000 people owning more than $1 million and 260 billionaires. Total tax revenue under scenario 1 accounts for about 0.7% of total income and revenues in scenario 2 accounts for 1.0% of total income. In Latin America, there are 1.9 million people owning more than $1 million and 105 billionaires. Total tax revenue under scenario 1 accounts for about 1.1% of total income and revenue in scenario 2 accounts for 1.3% of total income. In MENA, there are 915,000 people owning more than $1 million and 75 billionaires. Total tax revenue under scenario 1 accounts for about 0.5% of total income and revenue in scenario 2 accounts for 0.6% of total income. In Russia and Central Asia, there are 230,000 people owning more than $1 million and 133 billionaires. Total tax revenue under scenario 1 accounts for about 0.8% of total income, and total tax revenue under scenario 2 accounts for 1.4% of total income.

Let us stress the fact that tax revenue in each of our scenarios here is quite substantial. In scenario 1, 0.5-3% of national income is generated by tax depending on the region. This is considerable given that such a tax would not raise taxes for 98-99% of the global population in each region and considering that, in scenario 1, wealth would continue to grow significantly at the top of the distribution (tax rates are significantly below the average wealth growth rates observed for the groups over the past decades). In fact, there are only very few taxes which can generate significant revenue, while impacting such as small fraction of the population.

Factoring-in behavioral responses to wealth taxation

The estimates presented above include basic tax evasion with two parameters: a tax evasion rate and a capital stock depreciation or appreciation rate. Our tax evasion parameter defines the expected share of unreported taxable wealth due to the multiple forms of tax evasion (underreporting, offshoring, fraud, etc.). An evasion rate of 10% means that 10% of the net value of taxable wealth will not be reported and therefore that revenue will be 10% lower than what it could be, absent tax evasion. The stock depreciation or appreciation parameter helps to anticipate the potentially negative or positive impacts of wealth taxation on asset prices. Assuming a depreciation parameter of 15% amounts to assuming that the market value of financial and non-financial assets declines by 15% following the introduction of a wealth tax. The benchmark estimates presented above take into account tax evasion and depreciation (respectively 10% and 15%).

Assuming an evasion of 0% and a capital depreciation of 0% generates 2.1%, 2.7%, 7.0% of global income as wealth tax revenue for scenarios 1, 2 and 3 respectively. Assuming an evasion rate of 40% and a capital depreciation rate of 10% generates 1.2%, 1.5% and 3.8% of wealth tax revenue respectively. In North America, even in the most conservative scenario, both in terms of taxation rates and evasion and capital depreciation, revenue generated still amounts to 2% of national income. On the other hand, it could reach 11% of national income under the third tax scenario, and absent evasion and depreciation. Let us stress that behavioral responses to wealth taxation obey no law of nature–they are governed by tax policy choices (or lack thereof). The impact of wealth taxation on the overall stock of wealth also depends on how revenue is used. When recycled to improve access to basic education and healthcare, this revenue can provide an economy with a chance to improve its productive potential and helps to appreciate the stock of wealth. In chapters 8 and 9, we discuss policy options to reduce tax evasion and enhance the productive potential of wealth taxes. Chapter 10 discusses options on how to use wealth tax revenue.

Box 7.1 Learning from past and current examples of progressive wealth taxation

Most European countries have abolished progressive wealth taxation in recent decades. This specific form of wealth taxation applied in a number of European countries had three main weaknesses. Firstly, there was tax competition (for example the French wealth tax was immediately cancelled out when moving from Paris to London) and offshore evasion (until recently there had been no cross-border information sharing). Secondly, European wealth taxes had low exemption thresholds, causing liquidity problems for some moderately wealthy taxpayers with few liquid assets and limited cash income. Thirdly, European wealth taxes, many of which had been designed in the early 20th century, had not been modernized, perhaps reflecting ideological and political opposition to wealth taxation in recent decades. These wealth taxes relied on self-assessments rather than systematic information reporting. These three weaknesses led to reforms that gradually undermined the integrity of the wealth tax: the exemption of some asset classes such as business assets or real estate, tax limits based on reported income, or the repeal of wealth taxation altogether.

A modern wealth tax can overcome these three weaknesses. First, offshore tax evasion can be fought more effectively today than in the past, thanks to a recent breakthrough in cross-border information exchange. Besides, wealth taxes could apply to expatriates (for a few years at least), alleviating concerns about tax competition. Second, a comprehensive wealth tax base with a high exemption threshold and no preferential treatment for any asset classes can dramatically reduce avoidance possibilities and apply to the truly wealthy class who by definition do not face liquidity issues. Third, by leveraging modern information technology, tax authorities have the opportunity to collect data on the market value of most forms of household wealth and use this information to pre-populate wealth tax returns, reducing evasion possibilities to a minimum. As a matter of fact, the recent wealth tax proposals made in the United States have a high exemption threshold ($50 million instead of $1 million or less for European wealth taxation), a comprehensive tax base with no exemptions, and aggressive tax enforcement2–3.

1 On top of the 2,750 billionaires in the WID.world dataset, there are 5 billionaires in the Forbes’ rich list residing in very small jurisdictions not available as countries on WID.world.

2 Saez, E. and G. Zucman. Fall 2019. “Progressive Wealth Taxation.” Brookings Papers on Economic Activity, 437-511

3 The weaknesses of existing progressive wealth taxes are described in detail and how to remedy them.